Ready When You Need It? Unpacking Congress's Stock Trading Reform Options

As allegations of insider trading swirl around the April 10th tariff pause announcement, four competing bills await their moment. But which one is actually ready for prime time?

After Trump's April 10th tariff pause sent markets soaring, Rep. Marjorie Taylor Greene disclosed her well-timed purchases of between $21,000 and $315,000 in stocks including Apple, Amazon, FedEx, and Nike, just before the announcement, raising concerns about insider trading. We may have to wait 30 to 45 days or more for other members' financial reports. If these disclosures reveal more suspicious activity, does Congress have real solutions ready to implement, or just empty gestures?

In this 2nd article in a series, I use Kingdon's policy stream to analyze proposals already on the shelf. Is at least one ready to go if a policy window opens? Read the full series:

Part 1: The Problem with Congressional Stock Trading: A Crisis of Ethics and Accountability

Part 2 (this article): Ready When You Need It? Unpacking Congress's Stock Trading Reform Options

Part 3: Coming Soon

Part 4: Coming Soon

Four Bills: Breaking Down the Options Through Kingdon's Policy Stream Lens

Congressional ethics reform has historically followed a pattern of scandal-driven changes rather than proactive governance. After the Watergate scandal, Congress passed the Ethics in Government Act of 1978, requiring financial disclosures but with minimal restrictions on investing. The STOCK Act of 2012 came after a 2011 "60 Minutes" exposé on congressional insider trading but left significant loopholes that current proposals aim to address. Each reform cycle has incrementally tightened rules while carefully protecting members' perceived financial interests. This historical trajectory suggests that viable reforms typically balance meaningful constraints with political palatability.

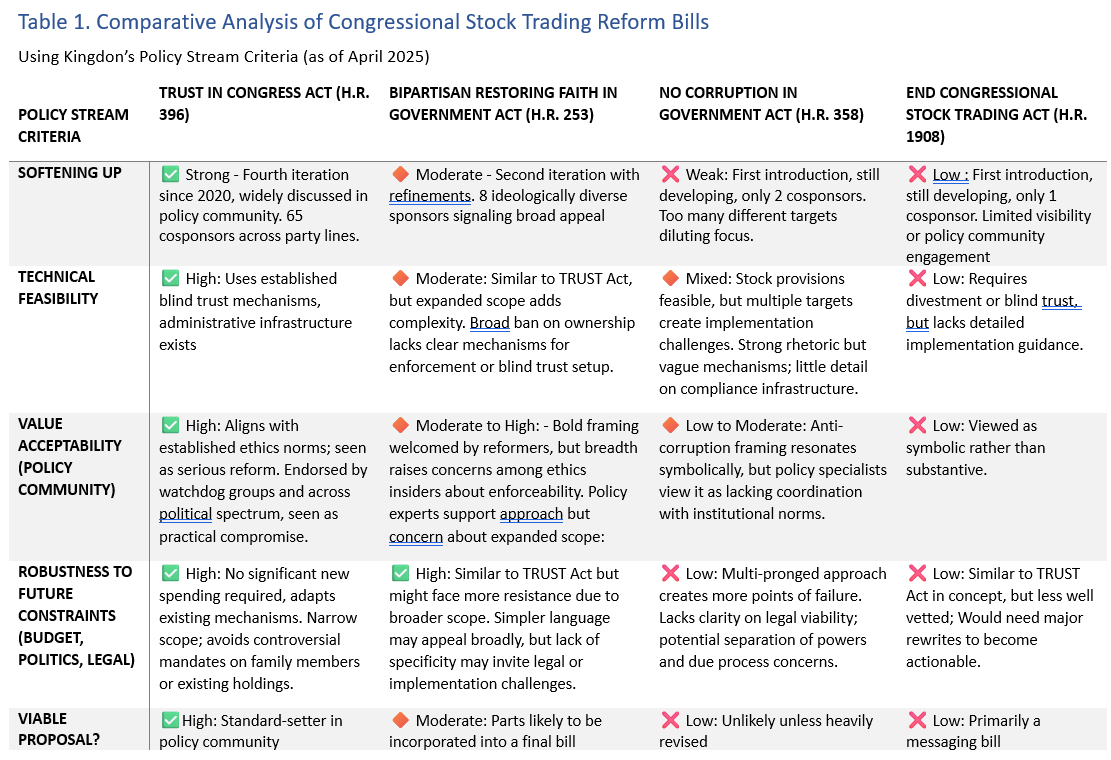

When examining potential solutions through Kingdon's policy stream framework, we need to evaluate whether proposals are technically feasible, align with the policy community's values, and can withstand future constraints. Congress currently has four competing bills addressing its stock trading problem. I've reviewed them all against these criteria, and there's a clear hierarchy in terms of development and viability.

The Frontrunner: TRUST in Congress Act (H.R. 396)

The TRUST Act is the grownup in the room. With 65 bipartisan cosponsors and multiple iterations since its first introduction in June 2020 by Rep. Abigail Spanberger (D-VA), it's had plenty of time to be "softened up"—that essential process where ideas get vetted, improved, and normalized within the policy community.

This bill takes a practical approach, requiring members of Congress, their spouses, and dependent children to either divest from individual stocks or place them in a qualified blind trust. As Rep. Emanuel Cleaver put it: "Just as we prevent athletes from betting on games in which they can have a direct impact on the outcome or inside information about the team's performance, it is common sense to ban lawmakers from investing in stocks."

Backgrounder: A blind trust is a financial arrangement where a public official places their assets under the control of an independent trustee, who manages those assets without any input or knowledge from the official. The goal is to eliminate conflicts of interest, since the official no longer knows exactly what investments they hold or how decisions they make in office might affect their personal wealth. This mechanism is particularly important for members of Congress who regularly receive non-public information about industries, companies, and regulations that could affect stock prices. Without blind trusts, members face persistent questions about whether their official actions are influenced by their investment portfolios, even when no wrongdoing occurs.

The bill isn't reinventing the wheel—it builds on qualified blind trust (QBT) mechanisms already used in the executive branch. In fact, the Senate Ethics Committee just released a guide in February detailing how these trusts work, suggesting the administrative infrastructure is essentially ready to go.

It’s particularly telling that the bill has endorsements from across the political spectrum—from Public Citizen to Americans for Prosperity. When you get that kind of ideological diversity on board, you know your policy has cleared some serious hurdles.

The Strong Contender: Bipartisan Restoring Faith in Government Act (H.R. 253)

This bill has the advantage of truly strange bedfellows—Rep. Brian Fitzpatrick (R-PA) and Rep. Alexandria Ocasio-Cortez (D-NY) don't team up to sponsor bills every day. Their proposal takes a slightly stronger approach than the TRUST Act, with expanded applicability to dependents and tougher enforcement language.

CREW's Policy Director Debra Perlin cut to the chase about this bill: "The Bipartisan Restoring Faith in Government Act's complete prohibition on Congressional stock ownership demonstrates that in our democracy the public's needs, rather than members' stock portfolios, come first."

While this bill could face more resistance from members worried about their families' financial independence, its broad ideological backing gives it serious credibility in policy circles.

The Kitchen Sink: No Corruption in Government Act (H.R. 358)

This bill tries to solve multiple problems in one bill—tackling insider trading, lobbying restrictions, AND automatic pay adjustments all at once. Although it might seem efficient, by attempting to address multiple ethics concerns simultaneously, it creates unnecessary complexity. Focused solutions are easier to implement than sprawling reforms, and this bill fails the simplicity test.

The Latecomer: End Congressional Stock Trading Act (H.R. 1908)

This bill is essentially a press release masquerading as legislation. With only one cosponsor and minimal detail on implementation, it signals intent without providing a roadmap. Sometimes bills are serious about implementation, and other times they’re introduced as “messaging bills” intended to nudge the conversation in a different direction. This one falls squarely in the latter category. Without specific enforcement mechanisms or administrative guidance, it would need major rewrites to be viable on its own.

So Which Option(s) Could Actually Work?

When I apply Kingdon's criteria systematically, the TRUST in Congress Act clearly emerges as the most viable alternative. It's gone through years of development, has established implementation mechanisms, and enjoys broad acceptance within the policy community.

To systematically compare these four proposals through Kingdon's policy stream criteria, Table 1 summarizes these findings and clearly illustrates why the TRUST Act emerges as the most viable option currently available.

If the April 10th tariff pause reveals more instances of suspicious trading, the TRUST Act is essentially sitting on the shelf, ready to go. In policy terms, that's gold—a fully developed solution waiting for its moment.

The Bipartisan Restoring Faith in Government Act also shows promise and might actually serve as a negotiating anchor to strengthen whatever final bill emerges. I wouldn't be surprised to see elements of both bills combined if momentum builds.

The other two bills face significant viability challenges. The No Corruption in Government Act tries to do too much at once, while the End Congressional Stock Trading Act simply lacks the specifics needed for serious consideration.

Are We Heading Toward a Solution?

My analysis of the policy stream reveals a clear hierarchy of readiness among competing proposals. The TRUST Act stands as the most viable option, having undergone extensive softening up since 2020. The Bipartisan Restoring Faith in Government Act offers a stronger but less refined alternative that could influence the final legislation.

If the April 10th tariff pause incident proves to be the focusing event that many observers anticipate, Congress will need a ready-made solution—and the TRUST Act is essentially waiting in the wings. For policy windows are both unpredictable and fleeting; when they open, only proposals that have been fully developed have any chance of advancement.

Yet policy viability alone cannot guarantee success. In my next article, I'll examine the political stream surrounding congressional stock trading reform—analyzing how shifting public opinion, interest group alignments, and internal congressional dynamics could either facilitate or obstruct meaningful change. As we'll see, even the most technically sound policy requires favorable political conditions to advance from proposal to law.

For Capitol Hill staffers working on these issues: while policy development is crucial, ultimate success will depend on how effectively reform advocates can leverage the current moment to build political momentum. The most technically viable solution may fail without strategic alignment with the political stream—a challenge I'll address in part three of this series.

[Sources listed at end of post]

The Long Game: How Policy Ideas Get "Softened Up" for Prime Time

When I teach Kingdon's Multiple Streams Framework to my students, the process of "softening up" tends to capture their imagination. It's the critical but often invisible work that happens long before a policy becomes law: an extended process through which proposals are introduced, discussed, revised, and gradually acclimated within policy communities and the broader public.

Keep reading with a 7-day free trial

Subscribe to Views Through a Policy Prism to keep reading this post and get 7 days of free access to the full post archives.