The Problem with Congressional Stock Trading: A Crisis of Ethics and Accountability

When the stock market surged following Trump's tariff pause announcement, it reignited debates over insider trading rules for government officials—a system where legality and ethics often diverge.

Every few years, we witness this predictable cycle: suspicious stock trades by politicians, public outrage, proposed legislation, and ultimately... nothing changes. But this latest tariff-related controversy feels different—not just because of its scale or timing, but because it exposes how our current rules have created different standards for those in power versus everyone else. This is the first in a series examining this issue through the lens of policy process theory.

The Tariff Pause That Sent Stocks Soaring

On April 10, 2025, President Donald Trump abruptly announced a 90-day pause on his administration's international tariffs. The announcement, made during an afternoon press conference, sent financial markets into an unprecedented rally. By market close that day, the S&P 500 had jumped 9.5% and the Nasdaq had surged 12.2%—the largest single-day gains for both indices in over 15 years.

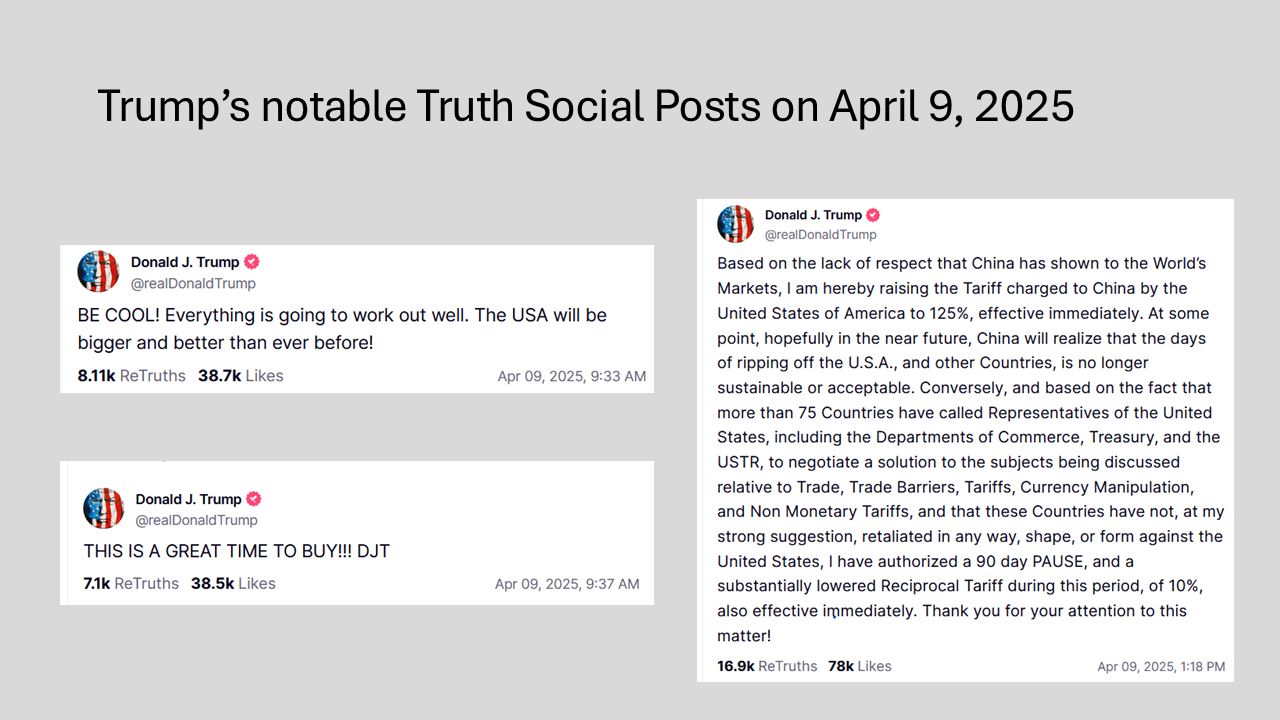

If these record gains suggest motivation for insider trading, was there also opportunity? The evidence suggests yes. More than three hours prior to the tariff pause announcement, Trump posted on Truth Social: "THIS IS A GREAT TIME TO BUY!!! DJT." Additionally, Nasdaq call volumes mysteriously spiked in the 20 minutes before Trump announced the tariff pause, suggesting not only opportunity but circumstantial evidence that insider trading might have occurred.

Backgrounder: Insider trading occurs when someone uses confidential, market-moving information to trade securities before the public has access to that information—and they're under a duty to keep it private. Market manipulation happens when someone attempts to artificially influence a stock's price by creating false impressions about supply, demand, or price. Both are illegal under federal securities laws, but proving either requires significant evidence of intent and causation.

Representative Marjorie Taylor Greene (R-GA) has come under scrutiny for her well-timed trades. She disclosed that in the two days preceding the tariff pause, while markets were still reeling, she purchased between $21,000 and $315,000 in stocks including Apple, Amazon, FedEx, and Nike. While Greene maintains these investments were managed by a financial advisor and properly disclosed, the timing has fueled allegations of potential insider knowledge.

Democrats in Congress have responded swiftly. Representative Alexandria Ocasio-Cortez immediately posted on X: "Any member of Congress who purchased stocks in the last 48 hours should probably disclose that now. It's time to ban insider trading in Congress." On April 11th, Senators Warren, Schumer, Wyden, Kelly, Gellego, and Schiff asked SEC Chairman Paul Atkins to investigate potential illegal actions related to Trump's tariff announcements.

Democratic Representative Hakeem Jeffries has backed legislation going beyond the STOCK Act's disclosure requirements, calling for a comprehensive ban on trading individual stocks that his predecessor, Nancy Pelosi, had opposed. Some Republicans have also voiced support for tighter restrictions.

But we've seen this movie before, haven't we? So why has this particular episode captured such attention once again? To understand, we need to examine how this issue is taking shape in what policy scholars call the "problem stream."

Defining the Problem: A Crisis of Trust in Governance

John Kingdon's Multiple Streams Framework (MSF) helps us understand how public problems are recognized and defined. In the problem stream, issues gain attention through three key factors: indicators, focusing events, and feedback from existing policies. The congressional stock trading issue illustrates all three at work.

Indicators: Measuring the Scale of Congressional Conflicts

The most compelling indicators of this problem's severity include:

A striking 95% of senators and representatives in the 118th Congress owned stock, creating countless potential conflicts with their legislative duties

Recent polling shows that 86% of Americans across party lines support prohibiting members of Congress from trading stocks entirely

A Business Insider investigation revealed that between 2020 and 2021, at least 57 Members of Congress and 182 senior Capitol Hill staffers violated the STOCK Act by failing to report stock trades within the required timeframe

The STOCK Act's penalty for late disclosure—a mere $200 fine—amounts to what the Campaign Legal Center calls "hardly impactful deterrence from the potential millions to be made off the stock market"

These quantifiable metrics reveal not just isolated incidents but structural problems in how financial conflicts are managed in government. The data suggests a systemic issue where those responsible for oversight have direct financial stakes in the very markets their decisions affect.

Focusing Events: The Tariff Announcement as Attention Catalyst

The tariff pause announcement serves as what Kingdon calls a "focusing event"—a dramatic occurrence that draws attention to the underlying problem. What makes this particular event so potent is its combination of several troubling elements:

The extraordinary scale of market movements following the announcement

The timing of the president's social media posts encouraging stock purchases

The unusual market activity in the 20 minutes preceding his official announcement

The subsequent trading patterns of potentially multiple government officials, including Representative Greene

The direct connection between policy decisions and financial markets that affect policymakers' personal portfolios

Unlike previous congressional trading scandals, this event potentially implicates the entire executive branch policy process and multiple members of Congress simultaneously, giving it unprecedented visibility and impact.

The tariff pause created what MSF scholars call a "policy window,” indicating a window of opportunity for policy advocates to push for change. (More on this to come, later in the series.)

Policy Feedback: The STOCK Act's Failure

The current controversy arises from what Kingdon calls "policy feedback" from the STOCK Act of 2012. This law was designed to prevent such scenarios by prohibiting government officials from using non-public information for personal gain. However, its implementation has demonstrated serious limitations:

The enforcement mechanism relies primarily on self-disclosure rather than independent monitoring

Despite credible allegations in multiple cases, no Member of Congress has faced serious legal consequences for insider trading

The law's focus on disclosure rather than prohibition creates a situation where potentially problematic trades are simply reported after the fact

The law's weak penalties ($200 for late disclosure) provide little deterrent effect

This feedback reveals that the problem isn't just that officials might trade on inside information—it's that the system designed to prevent such behavior fundamentally lacks teeth. The STOCK Act's journey from celebrated reform to acknowledged failure demonstrates how policy feedback often reshapes the problem stream.

Problem Framing: Ethics vs. Legality

How we frame this problem matters significantly for potential solutions. Is this primarily:

A legal compliance issue requiring stronger enforcement of existing laws?

An ethical problem requiring new prohibitions on stock ownership for public officials?

A structural issue of conflicting interests embedded in our governance system?

The current framing of the problem has shifted significantly from the 2012 STOCK Act period. Then, the issue was primarily defined as one of information asymmetry—officials had access to market-moving information the public didn't. Today, the problem is increasingly framed as a fundamental conflict of interest that disclosure alone cannot solve.

This shift in problem definition opens the door to more comprehensive solutions that go beyond disclosure requirements. Many ethics experts argue that the principle of recusal that applies to judges should extend to lawmakers making decisions that affect their investments. Unlike judges who can recuse themselves from a case that raises conflict of interest concerns, Members of Congress are expected to represent their constituents and cannot recuse themselves from votes or committee work—making stock ownership potentially more problematic for legislators than for judges.

"The evolution of this problem definition illustrates Kingdon's insight that problems aren't objective conditions but socially constructed understandings. What's fundamentally changed in the public discourse is the recognition that legal compliance and ethical governance are not the same thing. The current system has created a vast gray area where actions can be technically legal yet fundamentally undermine public trust. The tariff pause controversy isn't just amplifying an existing problem—it's exposing the fundamental inadequacy of a system that tries to address ethical failures through legal technicalities and disclosure requirements alone.

As we'll explore in future installments of this series, this redefinition of the problem from a legal compliance issue to an ethical governance crisis opens the door to very different policy solutions than those attempted in the past.

(Sources appear at the end of this article)

This article is part one of a four-part series examining Congressional stock trading concerns through the lens of Multiple Streams Framework. Coming up next: The Policy Stream: Competing Solutions to Congressional Trading.

PREMIUM CONTENT

Keep reading with a 7-day free trial

Subscribe to Views Through a Policy Prism to keep reading this post and get 7 days of free access to the full post archives.